Bitcoin enters the final day of the quarter in a tight coil of technicals and macro catalysts, with traders fixated on a handful of levels that will likely set the tone for October. Ostium Research’s week-ahead outlook frames the setup as a fading “window of weakness” into a potential Q4 tailwind, but only if the market navigates an event-heavy calendar without losing critical supports. As author Nik Patel puts it, “weekly momentum is still supportive of higher prices and I believe we are now emerging from the window of weakness I had marked out from Friday 20th Sept.”

Key Bitcoin Levels Signal Explosive October

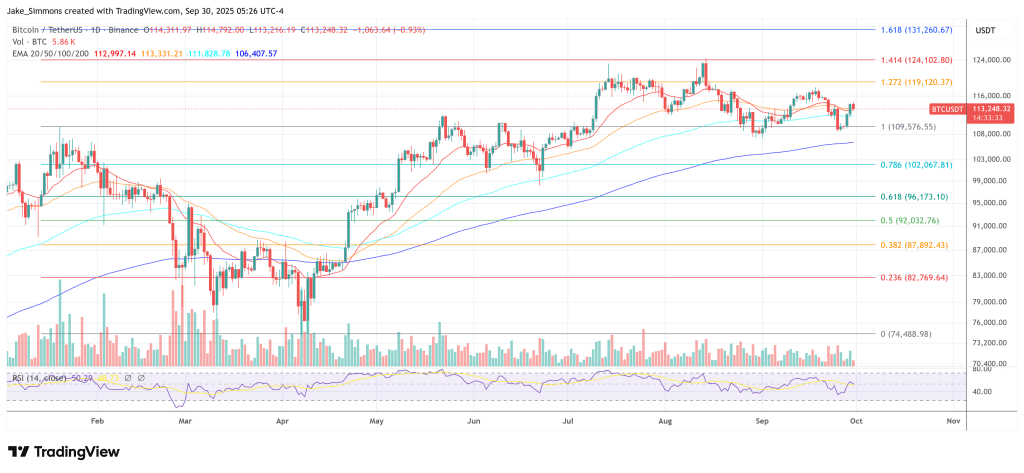

Spot price action remains defined by last week’s rejection at the August open near $112,000 and a swift slide into the low-$108,000s before a rebound into Sunday’s close. On the weekly timeframe, momentum still tilts higher, but Patel warns that quarter-end, the October turn, and a dense run of data can stretch volatility.

His base case is unambiguous: “I think any dip you get this week is one you want to look at as an opportunity for longs for the remainder of Q4,” he writes, adding that concerns about a cycle top in October are misplaced given “tailwinds into mid-Dec.” The mid-cycle risk marker sits around $99,000, with a longer-term invalidation tied to the 360-day moving average near $97,900. “Unless we lose $99k on a weekly close, nothing here looks mid-term bearish to me,” Patel states.

Related Reading

On the daily chart, the market carved a higher low above roughly $107,000 after the $112,000 rejection, keeping the short-term structure constructive. Patel’s upside trigger is precise: “If we do now push higher off this low through the rest of this week to close back above the August open and trendline resistance up near $115.7k, I think it is very unlikely you see $107k–$108k retested in October.” Conversely, he stresses the downside waypoint in a volatility burst: “I think the lowest we see this week is the 200dMA at $104.6k on a major flush of the lows.”

The tactical map he sketches gives bulls and bears something to do, sometimes within the same session. On the long side, he favors fading a stop-hunt under last week’s low or into the September open, “with invalidation on a close below the 360-day moving average, currently at $97.9k, below which we have not closed since March 2023.”

If the market squeezes first, he outlines a switch-hitter approach: a sharper rally into the quarterly close that “takes out the $114k high into Oct 1st,” followed by a fade on bearish divergence aiming “for at least $110k, if not $108.5k into the weekend,” where he’s prepared to flip long again.

Related Reading

Macro complicates an otherwise orderly technical picture. Patel expects the dollar to overextend before rolling over, a sequence that would support risk later in Q4: last week’s post-FOMC dollar bid is “short-lived,” with DXY “99 as the highest I am expecting,” and a larger move toward 93 in Q4 if momentum breaks down beneath the September open. On equities, he anticipates “a little choppier” October than crypto but still frames dips as opportunities into year-end.

Positioning and derivatives context backstop the directional view. Patel highlights snapshots across Velo and CoinGlass, three-month annualized basis, and Bitcoin versus altcoin open interest, then overlays expected one-week and one-month liquidation clusters to illustrate where forced flow could accelerate either path. The through-line remains that this week’s volatility is likely the prelude, not the postscript, to Q4. “The opportunity for those lows to be cleaned up should be over the next 5–7 days,” he notes. “If we run last week’s low and then reclaim on the lower timeframes, that could be the October low forming early.”

In sum, Bitcoin’s near-term riddle is less about trend decay than the choreography of a shakeout. Above ~$112,000, buyers can press quickly toward the ~$115,700 pivot; beyond that, the all-time-highs narrative returns to center stage. Sweep the lows first and hold the $104,600–$107,000 shelf, and the market may be laying its October floor. Only a weekly close below $99,000 would meaningfully dent the Q4 bull case Patel maps out for readers this week. “You should not get bear-holed,” he writes. “As such, any dip between now and the weekend is where I am expecting the formation of an October low.

At press time, BTC traded at $113,248.

Featured image created with DALL.E, chart from TradingView.com