Bitcoin price hovered above $87,000 today as market sentiment and the Crypto Fear and Greed Index plunged to 11 out of 100, a level signaling extreme fear among investors.

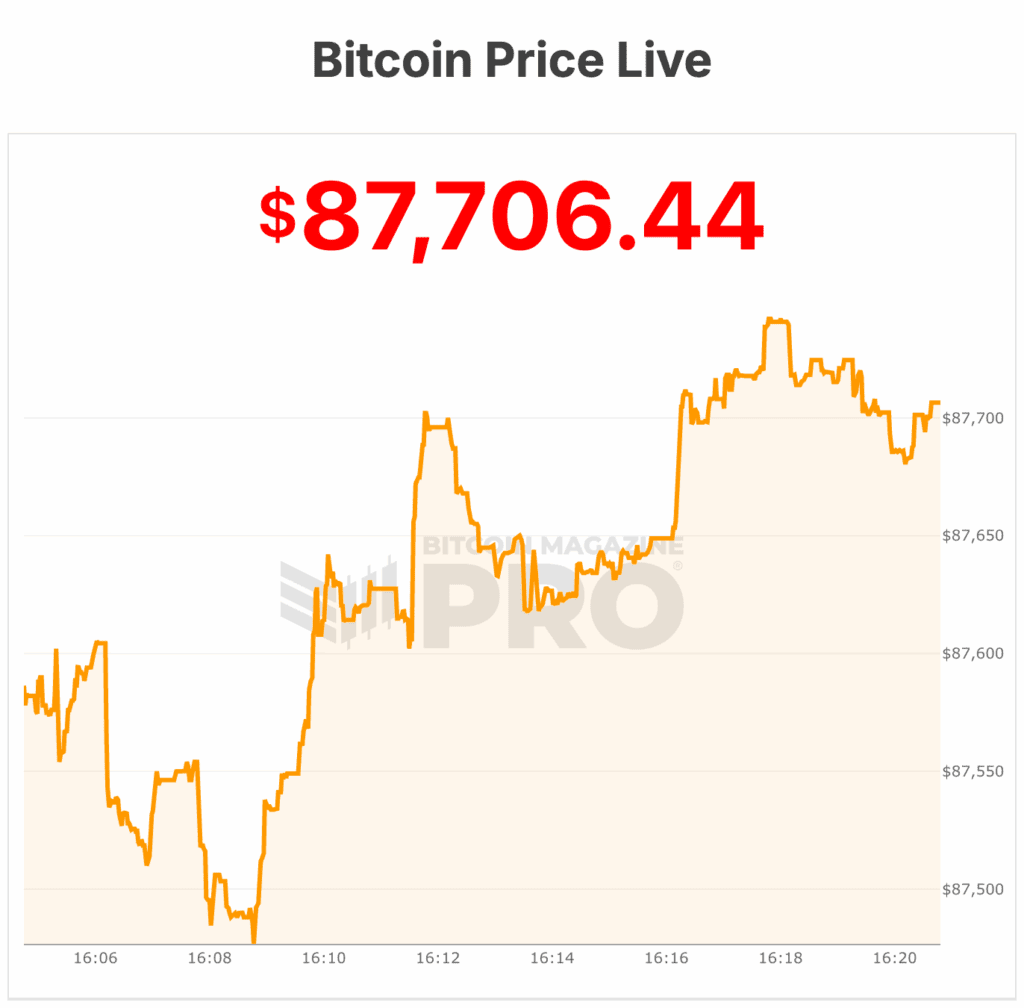

At the time of writing, the bitcoin price is trading at $87,696, up roughly 2% over the past 24 hours, according to market data. Despite the modest rebound, BTC remains trapped in a choppy consolidation range, sitting just 0.2% below its seven-day high of $87,918 and 2% above its weekly low near $85,575.

Yesterday, the bitcoin price cratered from close to $90,000 to the mid $85,000s.

Trading volume over the past day totaled approximately $51 billion, suggesting continued participation but little conviction on either side of the market. Bitcoin’s total market capitalization stood at $1.75 trillion, reflecting a 2% increase over the prior 24 hours, according to Bitcoin Magazine Pro data.

The uneasy price action comes as sentiment has turned decisively bearish. The Fear and Greed Index—a composite indicator that incorporates volatility, volume, social media trends, and momentum—has fallen deep into its lowest category, historically associated with panic-driven selling and heightened emotional decision-making.

Extreme fear hits crypto markets

A reading of 11 places the market firmly in “extreme fear,” a zone typically marked by heightened downside anxiety and risk aversion. Historically, such conditions have often coincided with local bottoms, though timing remains uncertain.

The index operates on a 0–100 scale, where readings below 25 indicate extreme fear and levels above 75 suggest extreme greed.

At current levels, investors appear more concerned about further downside than missing potential upside, reinforcing the defensive tone seen across digital asset markets.Market participants often view extreme fear as a contrarian signal, arguing that widespread pessimism can create favorable long-term entry points.

Thin liquidity amplifies downside moves

Bitcoin price’s recent slide below the $90,000 level occurred during typically illiquid weekend trading, exacerbating volatility as sellers encountered limited buy-side support. Prices fell from the low-$92,000 range late last week to weekend lows near $87,000, marking one of the sharpest short-term pullbacks since October’s all-time high.

The broader crypto market mirrored bitcoin’s weakness. Major altcoins continued to post double-digit monthly losses, while bitcoin dominance climbed toward 57%, underscoring a flight to relative safety within the digital asset complex.

Muted volumes suggest the move lower reflects caution rather than capitulation, with traders reluctant to deploy fresh capital ahead of key macroeconomic events.

Globally, attention is also turning to Japan, where the Bank of Japan is widely expected to raise interest rates. Such a move could pressure yen-funded carry trades that have supported global risk assets over the past year, potentially adding another headwind for crypto markets.

Bitcoin price levels in focus

From a technical perspective, analysts are closely watching the mid-$80,000 range as near-term support. A sustained break below this zone could open the door to a deeper retracement toward the low-$80,000s or below.

Conversely, holding current levels would reinforce the view that the bitcoin price remains range-bound rather than entering a prolonged bearish phase.

Despite the gloomy mood, long-term narratives remain intact for many investors, particularly as institutional participation continues to expand through spot bitcoin ETFs and broader regulatory clarity.

For now, however, bitcoin’s price action reflects a market caught between structural optimism and short-term fear—an uneasy balance that has pushed sentiment to one of its most pessimistic readings of the year.

Despite all this, earlier today, asset manager Bitwise released a new report that argues that bitcoin is poised to break from its historical four-year market cycle, setting new all-time highs in 2026 while becoming less volatile and less correlated with equities.

At the time of writing, the bitcoin price is $87,706.