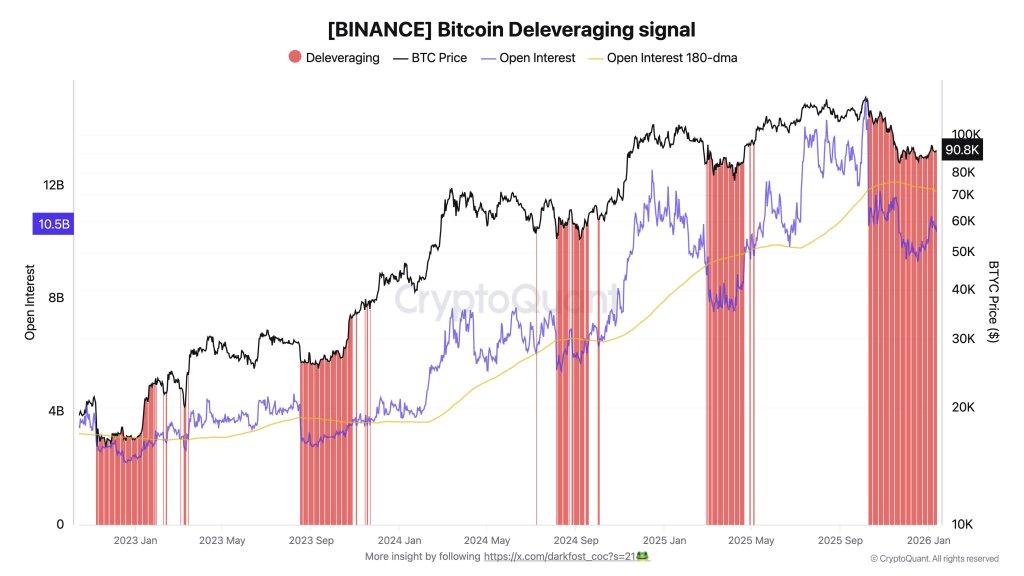

Bitcoin’s derivatives market is showing signs of a reset after a speculative 2025, with Binance open interest falling more than 31% from an October peak as futures-led selling pressure cools, a combination CryptoQuant contributor Darkfost argues often coincides with meaningful cycle lows.

In a series of posts on X, Darkfost said 2025’s leverage build-up was fueled by record activity on Binance, where futures trading volumes “exceeded $25T,” helping push Bitcoin open interest (OI) to an all-time high “of over $15B on October 6.”

“To put this into perspective, during the previous bull cycle in November 2021, when Bitcoin hit its ATH, open interest on Binance peaked at $5.7B,” Darkfost wrote. “In other words, OI nearly tripled in 2025. Since that peak, open interest has dropped by more than 31%, stabilizing today around $10B.”

Darkfost framed the move as a deleveraging phase that intensified amid “massive liquidations,” with OI slipping below its 180-day moving average, a condition the analyst says has historically mattered more than the raw level of leverage.

“These deleveraging periods are crucial, as they help purge the excess leverage built up in the market,” Darkfost wrote. “Historically, they have often marked significant bottoms, effectively resetting the market and creating a stronger base for a potential bullish recovery.”

Related Reading

The logic is straightforward: when leverage is forced out, the market can become less vulnerable to cascade-style liquidations and reflexive selling. In that sense, a lower OI environment can reduce the marginal impact of futures positioning on spot, at least compared with the late-stage “crowded trade” conditions that precede sharp drawdowns.

But Darkfost warned that a deleveraging signal is not the same thing as a confirmed bottom. “This could be the case again, but caution is warranted,” the analyst wrote, adding that if Bitcoin “continues to slide and fully enters a bear market,” OI could “contract further,” pointing to “deeper deleveraging and a potential extension of the correction.”

Bitcoin Sellers Are Losing Momentum

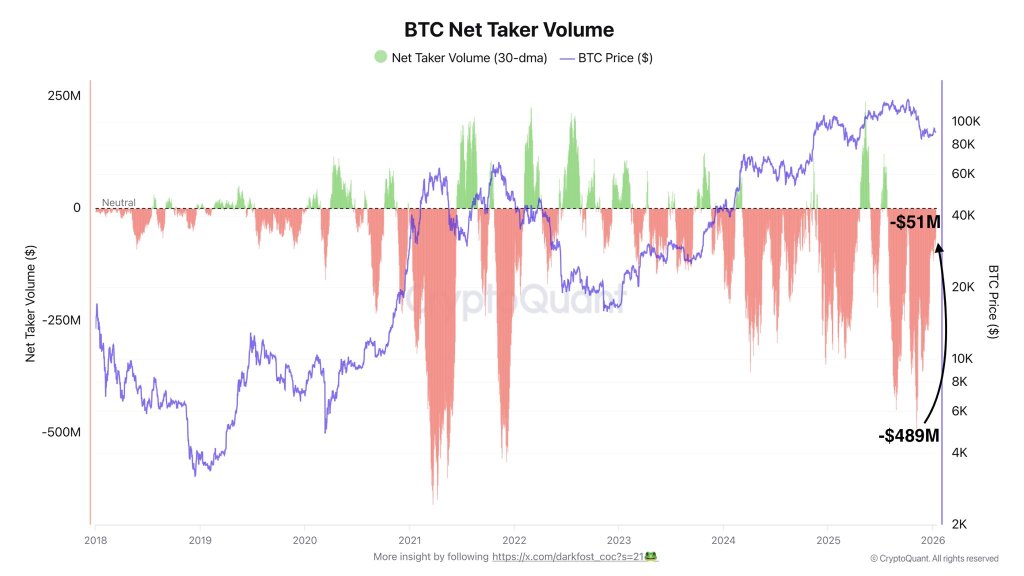

Alongside the open interest reset, Darkfost pointed to a sharp drop in futures-driven selling pressure, using Net Taker Volume — a measure intended to capture who is dominating futures order books.

Related Reading

“Selling pressure on BTC coming from the futures market is sharply declining,” Darkfost wrote, noting that after the monthly average hit “–$489M” at its peak, the figure has now been “divided by ten.” “At the moment, sellers still slightly dominate the order books, with –$51M,” the analyst added.

The key nuance is that the indicator has not flipped, but it is moving in that direction. “We have not yet returned to positive territory, but we are getting closer,” Darkfost wrote. “It is very encouraging to see traders starting to change their approach, especially given the significant impact futures volumes have on price action. Notably, since this decline in selling pressure began, BTC price action has also stabilized.”

For the “bottom thesis” to graduate into a more forceful reversal call, Darkfost anchored the trigger to that sign change: “If Net Taker Volume were to turn positive again, it would clearly ignite the fuse for a bullish reversal.”

At press time, BTC traded at $95,131.

Featured image created with DALL.E, chart from TradingView.com